Question one

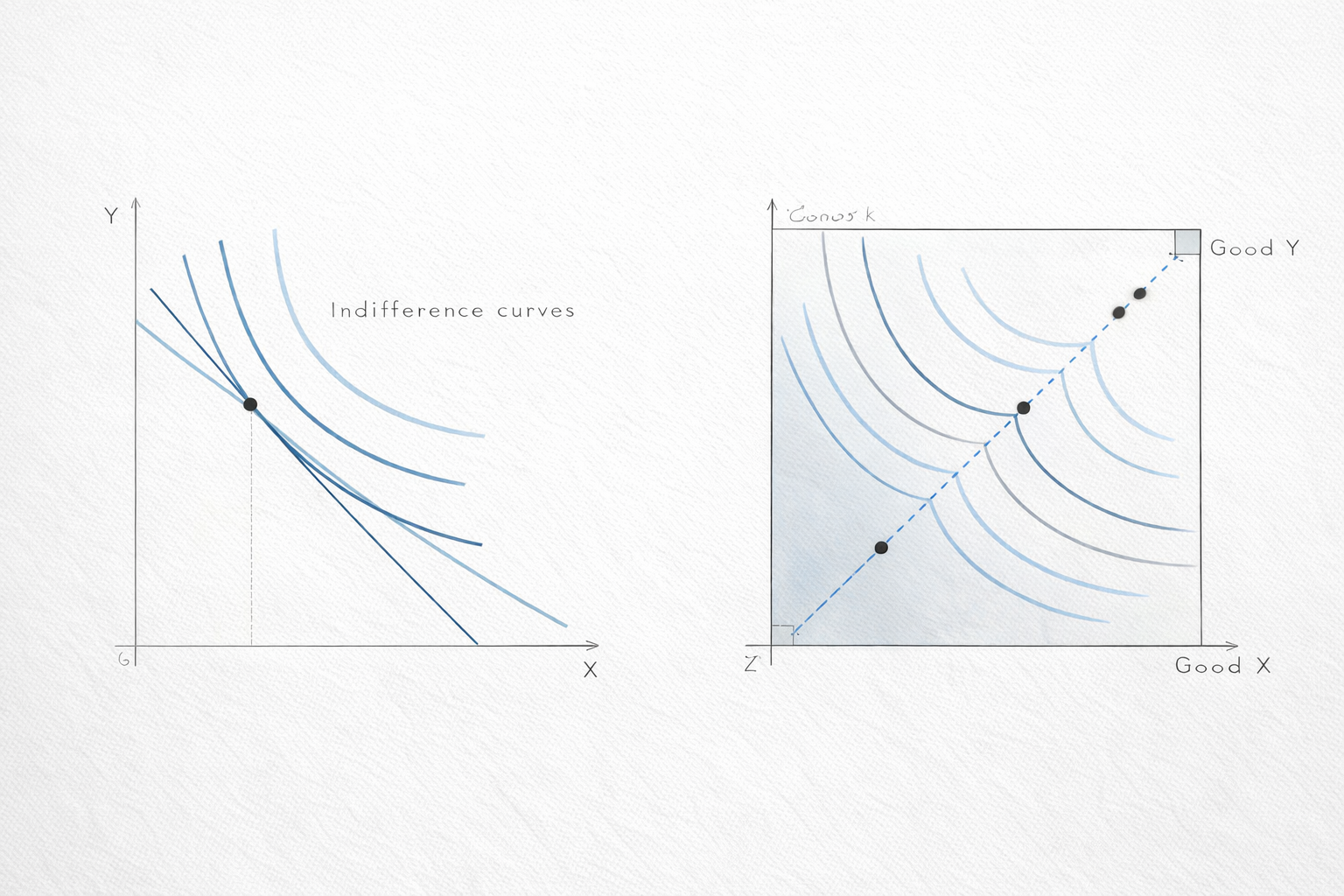

There is an error in the answer; they treat the income tax and quantity tax as have the same parallel shift in the budget line and then conclude the consumer is indifferent. There is confusion between pure income implication with a price distortion, i.e the unit tax. A quantity tax alters the relative price of the good taxed, hence the budget line rotates while an income tax minimizes the income without affecting price; hence shifts inwards in parallel. Hence, for the same government, a rational consumer would prefer income tax over quantity tax. Treating the two taxes as same overstates welfare under quantity tax and may result in wrong policy conclusions.

Question 2

For the solution, there is confusion on the tangency condition: for

the MRS is , and not

; therefore setting

gives

.

There is also a misapplication of the budget, by writing 3y + y = 70, which swaps prices. It then yields the wrong bundle and an invalid “demand for ” (they give

instead of a Marshallian demand in

).

The correct version using Cobb–Douglas demands is ,

with

; hence

and

. For

:

Hence the solution is reversed. Therefore, for the perfect complements, it should not use max or tangency, but the use of the Leontief form

, impose the fixed ratio

(kink); then intersect with the budget. Implication: Because the MRS and budget were mishandled, the derived demand and the reported optimum are wrong, so the diagram and conclusions are unreliable.

In conclusion, a rational consumer will consider the bundle (10, 40) under Cobb–Douglas preferences, considering the income allocation that maximizes utility where the budget line is tangent to the indifference curve

Question 3

From the answer, the assertion that trade will not be profitable is wrong because with the use of Cobb–Douglas preferences and endowments

,

, the initial bundles are far from each consumer’s preferred mix. Hence, trade is mutually beneficial while the competitive equilibrium allocations are on the higher indifference curves for A and B.

There is a drawing of the contract curve, but it is not justified since of identical and homothetic preferences, the Edgeworth both totals (50, 50), and the curve is 450 diagonals. The solution should indicate that because preferences are identical and homothetic, the contract curve is diagonal.

The MRS formula is wrong since ,

Hence correct . Tangency gives

.

The solution mixed price normalization and solving the prices since there is assumption that and

” and later solves

.

The correct normalized price set and solve for the other:

.

Marshallian demand used with wrong MRS since

For Cobb–Douglas with

,

,

There is confusion in the aggregate and individual income since ):

market-clearing price is not well derived since With ,

the solution further used 47.5 into A’s demand while living 27.1429 which is B’s quantity. Hence use ):

and ):

further the budget line that is drawn, the slope does not match the prices since the slope must be

Slope must be . Hence the price line is -0.75

The conclusion is wrong, which should indicate that, among the consumers, they are better off at the competitive equilibrium than their initial endowments.

Question 4

The solution states that C is “not rational” since prices bundle

would cost

but C purchased a more expensive

for

; this indicates that preference rationality is not “cheapest bundle,” it’s “best bundle among those affordable.” Check WARP: at

the chosen

costs

and the other bundle

it will cost

( hence, this was not affordable); at

the chosen

costs

and

would cost

, so

is directly revealed to be preferred to

and there is no reverse case. Correction: Choices satisfy WARP/GARP, hence it is per the utility maximization. As a consequence, the solution is reversed—C is economically rational; spending more at the second price vector simply reflects a preferred, affordable bundle, not a mistake.

Comments